ABSTRACT

Junk bonds are fixed-income instruments differently from other bonds like government bonds, foreign bonds, municipal bonds etc. These bonds generally are invested by all investors who are risk-lover. Because of that junk bonds are credited by credit agencies like Standard & Poors, Moody’s as non-investment grade, investors expect more earnings from these kind of investment instruments. It is also called as high yield bonds in the market. There are kinds of funds consisting of high yield bonds in the fund market. Hedge Funds are risky investment instruments, and these kind of funds are being managed by big investing companies, especially in the USA. These funds are consisted of real estate, stocks, derivatives, currencies, high yield bonds etc. Bond swapping is used companies to pay less amount of taxes to the government. It is generally implemented in the USA under the US laws accordingly. In this study, junk bonds, hedge funds and bond swapping are explained with graphs and examples.

JUNK BONDS

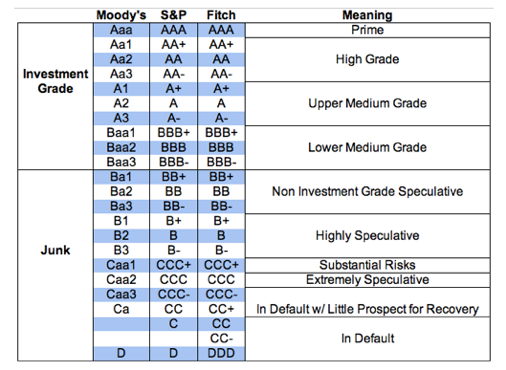

A high yield bond or junk bond is a bond which is rated below investment grade. Issued bonds with a rating of BBB- (S&P definition) or above are classified as investment grade bonds. The non-rated and rated bonds typically attract different types of investors. High yield bonds offer a nominal higher return on invested capital for the cost of a higher default risk and attract investors seeking more speculative and riskier investments than investment grade bonds. (Glenn Yago, 2003)

What Makes a Bond High Yield?

Credit rating agencies evaluate bond issuers and assign ratings. Issuers are rated on their ability to pay interest and principal as scheduled. Those issuers considered to have a greater risk of defaulting on interest or principal payments are rated below investment grade. These issuers must pay higher interest rates to attract investors to buy their bonds. While agency credit ratings define the high-yield market, and many investors rely on these ratings in their portfolio guidelines, investors may also conduct independent credit analysis of company fundamentals and other factors to form their own conclusions about a security’s risk of default. (PIMCO, 2016)

Who Issues High-Yield Bonds?

Issuers of high-yield bonds can be grouped into the following categories:

“Rising stars” are emerging or start-up companies that have not yet achieved the operational history, the size or the capital strength required to receive an investment-grade rating. These companies may turn to the bond market to obtain seed capital. Although start-ups can be risky, credit rating agencies consider their lack of a track record when issuing ratings. So a start-up company that qualifies for a single-B rating should have about the same risk level as a going concern with the same rating. In some cases, bonds may offer the first chance to participate in start-ups, before these companies offer their initial public offerings (IPOs) of stock to the public. Eventually, many rising stars grow to become larger companies with top credit ratings. (The Securities Industry and Financial Markets Association, 2016)

“Fallen angels” are former investment-grade companies that are experiencing hard times, which cause their credit to drop from investment-grade to lower ratings. If their prospects improve, some fallen angels can regain their investment-grade status.

Leveraged buyouts (LBOs) create a special type of company that typically uses high-yield bonds to buy a public corporation from its shareholders, often for the benefit of a private investment group that may include senior managers. Some corporate assets or divisions may then be sold to pay down the debt. (The Securities Industry and Financial Markets Association, 2016)

Capital-intensive companies turn to the high-yield market when they are not able to finance all their capital needs through earnings or bank borrowings. For example, cable TV companies require large amounts of capital to acquire, expand or upgrade their systems.

Foreign governments and foreign corporations, often less familiar to domestic investors, may rely on high-yield bonds to attract capital. Also, it should be noted that there are other risks –currency risk and political risk – that are unique to bonds issued by a foreign government/Corporation. (The Securities Industry and Financial Markets Association, 2016)

Considering a High Yield Bond Investment

High yield bonds may offer investors a number of potential benefits, coupled with specific risks. Investors can endeavor to manage the risks in high yield bonds by diversifying their holdings across issuers, industries and regions, and by carefully monitoring each issuer’s financial health.

Diversification

High yield bonds typically have a low correlation to investment grade fixed income sectors, such as Treasuries and highly rated corporate debt, which means that adding high yield securities to a broad fixed income portfolio may enhance portfolio diversification. Diversification does not insure against loss, but it can help decrease overall portfolio risk and improve the consistency of returns.

Enhanced Current Income

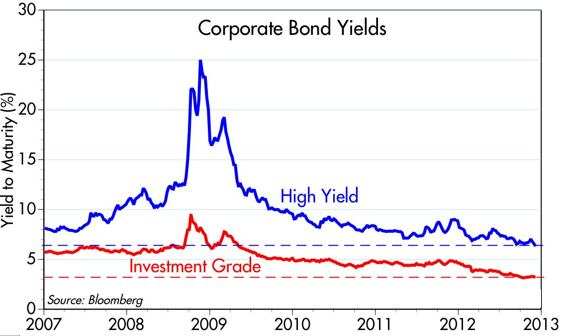

To encourage investment, high yield bonds usually offer significantly greater yields than government bonds and many investment grade corporate bonds. Average yields in the sector vary depending on the economic climate, generally rising during downturns when default risk also rises (high yield companies may be more negatively affected by adverse market conditions than investment grade companies). (PIMCO, 2016)

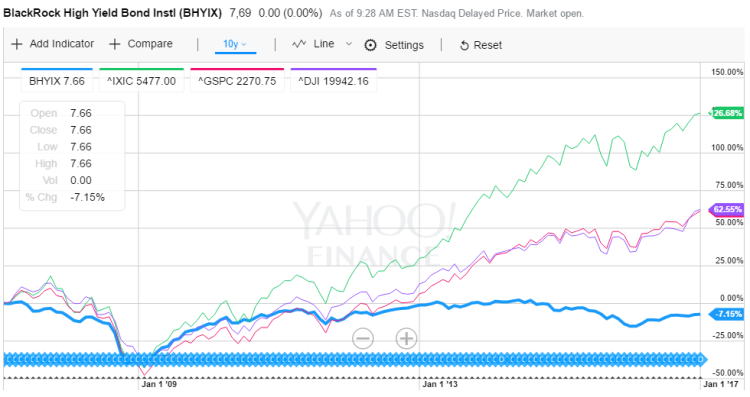

An Example: The BlackRock High Yield Bond Fund

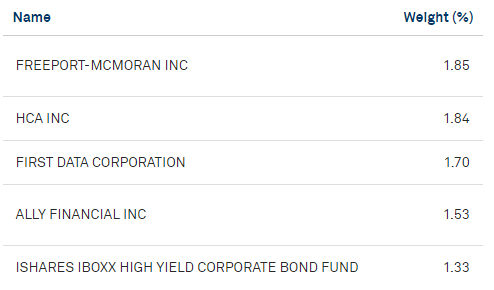

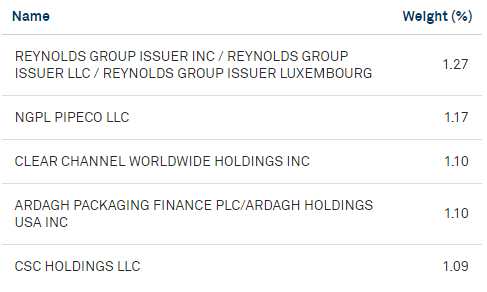

The BlackRock High Yield Bond Fund invests in non-investment grade bonds with maturities of 10 years or less. At least 80% of assets are invested in high-yield bonds, which include convertible and secured securities. The fund has $17 billion in AUM (Assets Under Management) with a yield of 5.54% as of November 2015. The fund began trading in 1998. The bonds in the fund have a weighted average maturity of 5.7 years and an effective duration of 3.98 years. Around 41% of the BlackRock High Yield Bond Fund’s holdings have ratings of B, with another 27.7% of its holdings having BB ratings. The fund has over 1,200 holdings in its portfolio with an expense ratio of 0.62%. The fund distributes its yields on a monthly basis.

In the graph, the bold blue line is Black Rock High Yield Bond Price; the green one is Dow Index; the purple one is NASDAQ; the red one is S&P 500 Indexes.

Top Fund Holdings in BlackRock High Yield Bond Portfolio

Risk Statistics of BlackRock

| 3 Years | 5 Years | 10 Years | ||||

| BHYIX | Category Average | BHYIX | Category Average | BHYIX | Category Average | |

| Alpha | 2.96 | 0.02 | 6.37 | 0.05 | 4.88 | 0.03 |

| Beta | 0.27 | 0 | 0.48 | 0 | 0.52 | 0.01 |

| Standard Deviation | 5.5 | 0.05 | 5.35 | 0.05 | 9.78 | 0.1 |

| Sharpe Ratio | 0.67 | 0.01 | 1.4 | 0.01 | 0.68 | 0.01 |

* Statistics were taken from Yahoo Finance on 5th January 2017.

As it can be seen that there is a big difference between ratios belong to BHYIX (BlackRock) and category averages in 3, 5 and 10 years.

Junk Bonds in 2008 Financial Crisis

Junk bonds are vulnerable to stressed market conditions such as the recession of 2008.

As the economy weakens, as it can be seen from the graph above, opportunities for businesses to secure funding begin to become more scarce and the competition becomes more intense. All of these conditions mean that some companies may face worst case scenarios, or bankruptcy, more often when the market experiences stress.

The European High Yield Market

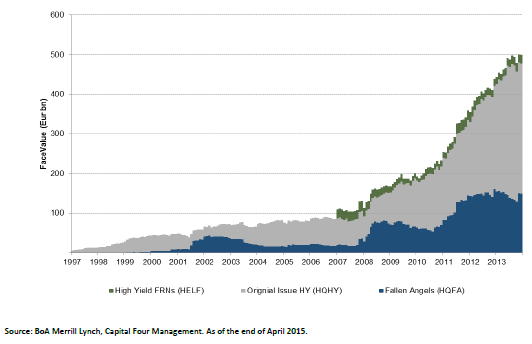

The European high yield market is a relatively young and small market compared to the rest of the debt capital markets. The high yield market consists of corporate debt with a credit rating below investment grade. This corresponds to a credit rating of BB+ or below. The first European high yield issues were done in the late 1990’s and were primarily concentrated on the telecommunications and media industry. In 1998, there was only around 5 billion EUR of European high yield debt outstanding. Most of these first issues ended up defaulting. However, the European high yield market has been one of the fastest growing parts of the debt markets ever since. During the early and mid-2000’s, the high yield market benefited strongly from the LBO wave, and the European high yield market reached 84 billion EUR in 2003. The Financial Crisis subsequently brought the market to a complete stop and there was not a single new issue in 2008. (Christina Marie Lie, 2015)

However, the increased reluctance of banks to finance corporations after the Financial Crisis brought new growth to the market. This led European corporations to shift away from bank financing and turn to the debt capital markets instead. (Barley, 2013) This development meant that the European high yield market reached 239 billion EUR at the end 2012. From here, the European high yield market has continued its strong growth, and as per the end of April 2015, the market stands at a value of approximately 678 billion EUR (BoA Merrill Lynch). Figure below graphically shows the development in the size of the market.

Figure: Size of the European High Yield Market

In Figure above, Original Issues refers to issues originally issued with a bond rating classifying a bond as high yield debt (BB+ or lower) that is still rated as high yield. Fallen Angels refers to issues originally issued with an investment grade rating that were subsequently downgraded to a high yield rating by at least two rating agencies. A recent example of this is the bonds of British retailer Tesco, which were downgraded to high yield in the spring of 2015. (Robert Smith, 2015) Lastly, FRNs refer to floating rate high yield bonds, which are still a smaller part of the market. Fallen angels are not very risky, it is not more than original high yield bonds.

As can be seen from the figure above, much of the growth in the last couple of years has come from original issues. This illustrates the increased dependence of European corporations on the debt markets in their financing decisions. It can also be seen that the increase in Fallen Angels seems to be highly correlated with the performance of the general economy. This is hardly surprising, and much of the increase in the level of Fallen Angels have been due to downgrading of banks following the Financial Crisis. (Phillips, 2013)

European high yield market has performed well in terms of cumulative returns over the last 10 years. Figure below shows the return of European high yield compared to other selected asset groups since 2002.

Figure: Cumulative Return of Selected Indicies

As can be seen from this figure, European high yield outperformed the other asset classes since 2002. Part of this is undoubtedly not due to astronomical returns from high yield, but due to the fact that most other asset classes saw relatively low returns over this period. However, it should still be interesting, from an empirical point of view, to look at the drivers of the returns to an asset class that has done so well over the past ten years.

Pricing a Fixed Rate Bullet Bond

In this section, we deal with the pricing of a fixed rate bullet bond, as this is most similar to our standard high yield bonds. Pricing a basic bullet bond is rather simple in the case where the bond pays a fixed rate and is risk-free, as one can simply discount the coupons and principal using a discounted cash flow approach. In this case, the formula for pricing a bond is:

In this equation, P is the price of the bond, C is the regular coupon payment of the bond, FV is the face value, n is equal to the maturity of the bond in years, and YTM (yield to maturity) is the effective risk-free interest rate.

In reality, however, the unknown in the equation above will not be the price, since this can be observed in the market. Instead, the unknown will be the effective interest rate (YTM). This rate can be backed out of the equation, since there will only be one effective interest rate that makes the discounted cash flows equal to the price observed in the market for a fixed rate bullet bond. In the case of a risk-free bond, the only relevant factor affecting the YTM is the risk-free rate (assuming that the bond is perfectly liquid). (Christina Marie Lie, 2015)

HEDGE FUNDS

A hedge fund is an alternative investment vehicle available only to sophisticated investors, such as institutions and individuals with significant assets.

Like mutual funds, hedge funds are pools of underlying securities. Also like mutual funds, they can invest in many types of securities. However, there are a number of differences between these two investment vehicles. (Barclay Hedge, 2016)

First, hedge funds are not currently regulated by the U.S. Securities and Exchange Commission (SEC), a financial industry oversight entity, as mutual funds are. However, it appears that regulation for hedge funds may be coming soon. (Barclay Hedge, 2016)

Unlike mutual funds, hedge funds are not subject to some of the regulations that are designed to protect investors. Depending on the amount of assets in the hedge funds advised by a manager, some hedge fund managers may not be required to register or to file public reports with the SEC. Hedge funds, however, are subject to the same prohibitions against fraud as are other market participants, and their managers owe a fiduciary duty to the funds that they manage. (US Securities and Exchange Commission, 2016)

Second, as a result of being relatively unregulated, hedge funds can invest in a wider range of securities than mutual funds can. While many hedge funds do invest in traditional securities, such as stocks, bonds, commodities and real estate, they are best known for using more sophisticated (and risky) investments and techniques. (Barclay Hedge, 2016)

Third, hedge funds are typically not as liquid as mutual funds, meaning it is more difficult to sell your shares. Mutual funds have a per-share price (called a net asset value) that is calculated each day, so you could sell your shares at any time. Most hedge funds, in contrast, seek to generate returns over a specific period of time called a “lockup period” during which investors cannot sell their shares. (Barclay Hedge, 2016)

Finally, a hedge fund manager oversees and make decision about the insvestment in a hedge fund. Managing a hedge fund is a lucrative job. As they are investing their own and other investors’ money to this fund, gaining a yield. Additionally he/she earns management fees (of the fund).

Hedge Fund Portfolio Construction

Most portfolio construction will probably blend bottom-up (manager selection) and top-down (asset allocation) approaches. Different investors will have different approaches and goals. These differences can be in terms of geographical focus, investment style or strategy.

Some investors put more weight on their personal network in the industry, while others have a more econometrical approach to portfolio construction. So, there is no accepted consensus as to how a hedge fund portfolio should be constructed. (AIMA’s Roadmap to Hedge Funds, 2008)

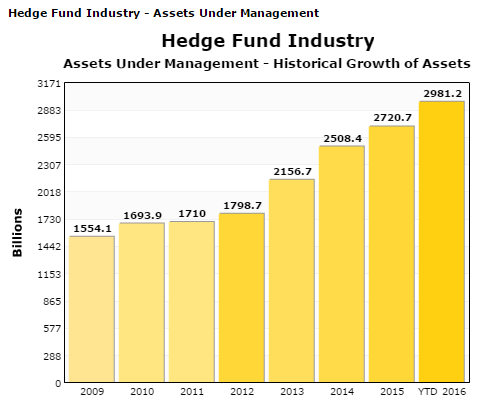

The global hedge funds’ assets under management (AUM) hit a high of $2.98 trillion in 2016.

*The chart above was taken from Barclay Hedge Alternative Investment Databases.

The graph below provides a map view of the global hedge fund industry.

Hedge Fund’s Performance

There are kinds of statistics and formulas like Sharpe Ratio (Measuring return/risk. Rate is thr dominator.), Beta (Measuring Hedge funds’ volatility and asking whether the hedge funds’ perfomance is more volatile than the market or vice versa.), Covariance, Kurtosis etc.

Due to the higher moment risk exposures, it is necessary to develop special methods for evaluating the performance of hedge funds.

- An analysis of investor preferences for higher order moments which are present in hedge fund returns.

- An analysis of multifactor models designed for the analysis of hedge fund performance that are based on location- and trading-factors(Holler, 2012)

Key Features of Hedge Funds

Absolute returns: Hedge fund managers pursue absolute returns rather than returns relative to an index or benchmark, with the goal of generating gains even when the traditional markets are failing or range bound. (MAN, 2016)

Skill-based strategies: Returns of hedge funds are derived mostly from the skill of the hedge fund manager in executing their chosen strategy rather than exclusively relying on asset appreciation in rising markets.

Flexibility: Hedge funds have the ability to trade on the long and short side of various financial instruments.

Diversity: Hedge fund managers trade across a spectrum of markets and exchanges, investing in a diverse array of financial instruments including equities, bonds, currencies and derivatives.

Alignment of interest: Hedge fund managers often invest their own money, which aligns their interests with those of their investors.

BOND SWAPS

A bond swap is simply the sale of bonds from your investment portfolio and the subsequent purchase of replacement bonds. Investors often engage in bond swaps close to year-end in order to realize tax benefits. They do this by taking a loss on the sale of a depreciated bond and using that loss to offset capital gains on their tax returns, thus avoiding the tax. (Bond Swapping, 2016)

Potential Benefits of Bond Swapping

- Realize losses for tax savings

- Take advantage of changing market conditions

- Recognize gains

- Improve quality

- Increase yield

- Boost annual income

- Consolidate small positions

- Shorten or extend maturities

- Enhance liquidity and diversification

Types of Bond Swaps

There are a number of reasons you might consider a bond swap. Here are some of the motivations: (Bond Swaps, 2005)

Quality swaps alter the overall credit quality of a fixed-income portfolio. You might change the credit quality from AAA-rated bonds to AA-rated bonds.

Yield (maturity) swaps change the yield and maturities of the bonds in your portfolio. If you are seeking to raise your overall yield, you might sell bonds with shorter maturities and purchase longer-term bonds. Bonds with longer maturities generally yield more than shorter maturity bonds.

Product swaps modify the type of bonds you hold. Treasury bonds, CDs (Certificate of Deposits), corporate bonds and municipal bonds are different sectors within the fixed-income markets, each with unique characteristics and yields.

Portfolio structure swaps change the makeup of the portfolio. Swaps can be used to increase the number of bonds within a portfolio, enhancing diversification.

Tax swaps deliver valuable tax benefits. If the value of a bond in your portfolio is less than its cost, you may sell the bond and use the capital loss to offset capital gains elsewhere in your portfolio.

An Example to Bond Swap

Sell $50,000 Home State Bond A

- AAA rated

- Purchased in October 1998 at 100.00

- 5.00% due 07.01.2024

- Sell Price 93.50

- Proceeds: $46,750

Buy $50,000 Home State Bond B

- AAA rated

- 5.00% due 05.01.2022

- Purchase Price 94.157

- Cost: $47,078.50

Outcome of This Bond Swap:

- (500 x $100) – (500 x $93.50) = 50,000-46,750=$3,250 tax-loss realized

- Maintained credit quality and income

- Shortened maturity by two years

- Investor must provide $328.50 (47,078.50-46,750) to make the swap work

CONCLUSION

Junk bonds and hedge funds are risky investment instruments in the market. Junk bonds are fixed-income investing tools like other bonds (investment grade). Bonds which are rated below investment grade (non-investment grade) by credit agencies are called as high yield bonds or junk bonds. Because of that, they are more risky bonds in the market. These kind of bonds issued by rising stars, fallen angel (before lowering its investment grade by a credit agency, it is called as investment grade bonds), capital-intensive companies or foreign governments and foreign corporations. In this study as an example, BlackRock High Yield Bond Fund is evaluated with graphs and kinds of indicators, ratios. How 2008 financial crisis affected to high yield bonds is explained. In the European high yield bonds, there are important variances in 2008 financial crisis in the sense of high yield bonds. Pricing high yield bonds look like pricing a fixed rate bullet bond. It is also explained with a formula. Hedge funds consisting of kinds of investment instruments including government bonds, corporate bonds, high yield bonds, etc. These kind of funds do not look like mutual funds. While mutual funds are regulated, hedge funds are not regulated in the USA. There is indexes and graphs showing contemporary situation of hedge funds in the World. Bond swaps are generally used for tax savings. However, they also helps organizations to improve bond investment quality, and increase yield in that way. In this study, in order to comprehend the issue, a bond swapping example is given at the end of the study.

RESOURCES

(2008). AIMA’s Roadmap to Hedge Funds. Alternative Investment Management Association (AIMA).

Barclay Hedge. (2016). Hedge Funds: barclayhedge.com/research/educational-articles/hedge-fund-strategy-definition/what-is-a-hedge-fund.html

Barley, R. (2013). Europe’s Long Road to the Bond Markets. The Wall Street Journal.

(2016). Bond Swapping. United Kingdom: RBC Wealth Management.

(2005). Bond Swaps. USA: PiperJaffray Guide.

Christina Marie Lie, M. L. (2015). Empirical Studies of Credit Spreads in the European High Yield Market. Copenhagen: Copenhagen Business School.

Glenn Yago, S. T. (2003). Beyond Junk Bonds, Expanding High Yield Markets-Junk Bonds Then and Now. New York: Oxford University Press.

Holler, J. (2012). Hedge Funds and Financial Markets. Gabler Verlag.

MAN. (2016). Hedge Funds: man.com/2/what-is-a-hedge-fund

Phillips, Y. (2013). High Yield Bonds Have Become a Global Opportunity. Russel Investments.

PIMCO. (2016). Investment Basics: High Yield Bond Basics: europe.pimco.com/EN/Education/Pages/TheRoleofHighYieldBonds.aspx

Robert Smith, A. M. (2015). Tesco Bonds Shrug Off Downgrade to Junk. Reuters.

The Securities Industry and Financial Markets Association. (2016). Types of Bonds: investinginbonds.com/learnmore.asp?catid=5&subcatid=19&id=197

US Securities and Exchange Commission. (2016). Hedge Funds: sec.gov/answers/hedge.htm

Ümitcan ÜNAL (Ocak 2017)

Not-1: Akademik döküman değildir, kaynak gösterilemez.

Notice: This document is not an academic resource; hence, it is not available in the sense of citations for any academic research.